car insurance Albertino

Auto insurance for your collection – Guide on how to protect your treasure

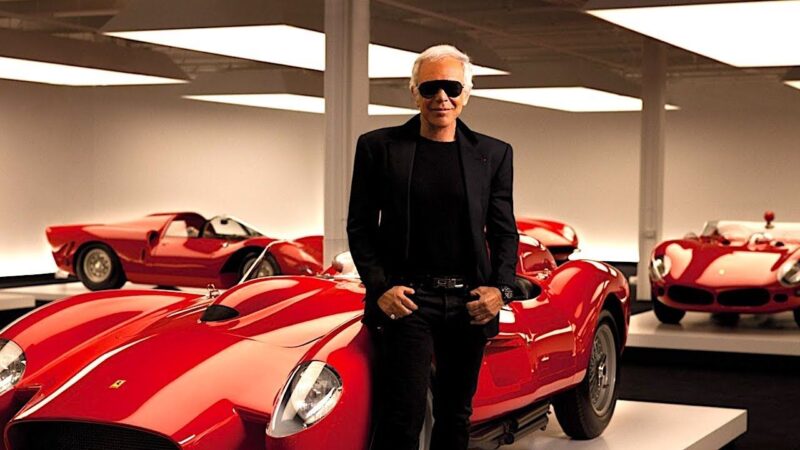

For individuals deeply passionate about vintage cars, those who have devoted considerable time and effort to curate a collection reflective of their enthusiasm, the paramount concern is undeniably the safeguarding of their valuable investment. Beyond the meticulous maintenance routines, an indispensable facet of preserving such a cherished collection involves securing each vehicle with the right insurance coverage. This comprehensive guide seeks to delve into the intricate process of insuring your car collection, offering not only peace of mind but also an essential layer of financial protection. By gaining a profound understanding of the nuanced realm of classic car insurance, you can guarantee not only the physical preservation but also the robust financial security of this esteemed and cherished assemblage.

Precise Vehicle Valuation:

Prior to initiating the insurance procedure, it is imperative to undertake a meticulous appraisal for each car within your collection. Given the tendency of vintage cars to appreciate over time owing to their rarity and condition, it becomes crucial to guarantee that the insurance policy aligns accurately with the current value of each vehicle. Collaborating with appraisers who specialize in classic cars proves to be a strategic approach for obtaining precise estimates. This ensures that your collection is not only safeguarded but also comprehensively protected in the event of any claims, underscoring the importance of accuracy in the valuation process.

Opting for Comprehensive Protection:

When exploring insurance options, it is prudent to select coverage that precisely caters to the distinct needs of classic cars. Certain insurers provide tailored coverage to shield against depreciation, safeguard against damage incurred during exhibition events, and even protect against the devaluation of original parts. Choosing coverage customized to the unique requirements of classic cars ensures a comprehensive and personalized safeguard that extends beyond generic offerings. This approach guarantees the thorough preservation of your valuable collection by addressing specific risks and potential challenges associated with the ownership of classic vehicles.

Grouping Vehicles:

It’s important to note that several insurers provide advantageous discounts for insurance policies covering multiple vehicles. Consolidating your collection under a single policy can result in considerable savings. It’s recommended to discuss this option carefully with your insurer, assessing its applicability to your specific situation. By exploring and taking advantage of multi-vehicle insurance discounts, you not only simplify insurance management but also optimize financial benefits, contributing to comprehensive and efficient protection of your classic car collection.

Detailed Documentation:

Maintaining detailed records of each car in your collection is essential. This includes photographs, maintenance documents, and records of all improvements made. This documentation can prove crucial in case of claims, assisting in proving the value of the vehicle and pre-existing conditions. Additionally, by keeping an organized and comprehensive file, you not only facilitate the claims process with the insurer but also contribute to preserving the history and authenticity of each car in your collection comprehensively.

Installation of Security Devices:

Installing security devices such as anti-theft alarms and GPS trackers not only strengthens the protection of your classic cars but can also result in significant insurance discounts. Be sure to inform the insurer about all implemented security measures to ensure that these devices are considered in the assessment of your premium. In addition to providing an additional layer of protection, the proactive adoption of security measures contributes to a safer and more economical experience, reinforcing the safeguarding of your classic car collection.

Negotiate Rates:

Do not hesitate to negotiate insurance rates for your classic car collection. Many insurers are open to collaborating with collectors, providing more favorable conditions. By explaining the specialized nature of your collection, highlight the unique details that make it exceptional. Explore the possibility of rate adjustments, considering the uniqueness and intrinsic value of each vehicle. Proactive negotiation can result in terms more suitable to the specific needs of your collection, ensuring effective and financially advantageous protection.

By adhering to these guidelines, you will be on the correct trajectory to guaranteeing the proper protection of your classic car collection. It’s essential to recognize that insurance transcends being merely a financial obligation; it serves as a vital safeguard to ensure the enduring preservation of your passion for classic cars. Embracing a proactive approach to security, maintaining accurate documentation, selecting tailored coverages, and negotiating judiciously are not only measures to shield your investments but also contribute significantly to the continual preservation and appreciation of this invaluable automotive collection over the years to come.

Seja o primeiro a comentar!